Profund Advisors LLC lifted its stake in shares of NetApp Inc. (NASDAQ:NTAP) by 14.1% in the 1st quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 9,660 shares of the data storage provider’s stock after purchasing an additional 1,193 shares during the period. Profund Advisors LLC’s holdings in NetApp were worth $596,000 at the end of the most recent quarter.

Profund Advisors LLC lifted its stake in shares of NetApp Inc. (NASDAQ:NTAP) by 14.1% in the 1st quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 9,660 shares of the data storage provider’s stock after purchasing an additional 1,193 shares during the period. Profund Advisors LLC’s holdings in NetApp were worth $596,000 at the end of the most recent quarter.

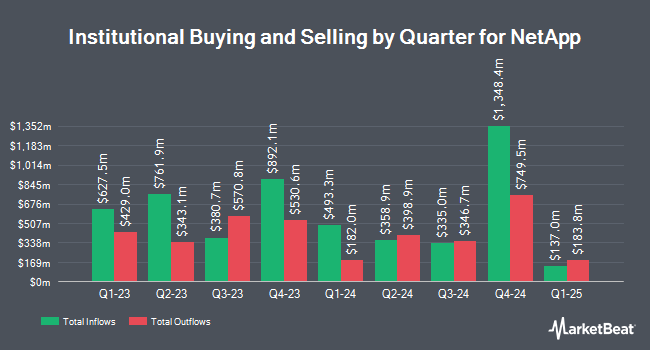

Several other hedge funds also recently modified their holdings of the company. BlackRock Inc. increased its stake in shares of NetApp by 0.9% during the 1st quarter. BlackRock Inc. now owns 20,465,300 shares of the data storage provider’s stock worth $1,262,508,000 after purchasing an additional 182,734 shares during the last quarter. Boston Partners increased its stake in shares of NetApp by 10.3% during the 1st quarter. Boston Partners now owns 13,381,688 shares of the data storage provider’s stock worth $825,516,000 after purchasing an additional 1,254,548 shares during the last quarter. Investec Asset Management LTD purchased a new stake in shares of NetApp during the 4th quarter worth approximately $290,829,000. Bank of New York Mellon Corp increased its stake in shares of NetApp by 6.4% during the 4th quarter. Bank of New York Mellon Corp now owns 4,322,669 shares of the data storage provider’s stock worth $239,131,000 after purchasing an additional 260,763 shares during the last quarter. Finally, JPMorgan Chase & Co. increased its stake in shares of NetApp by 488.7% during the 1st quarter. JPMorgan Chase & Co. now owns 3,537,659 shares of the data storage provider’s stock worth $218,239,000 after purchasing an additional 2,936,713 shares during the last quarter. Institutional investors own 90.87% of the company’s stock.

Get NetApp alerts:

In other news, CEO George Kurian sold 30,253 shares of NetApp stock in a transaction on Tuesday, May 22nd. The shares were sold at an average price of $67.52, for a total transaction of $2,042,682.56. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. Also, SVP Matthew K. Fawcett sold 16,188 shares of NetApp stock in a transaction on Tuesday, June 5th. The stock was sold at an average price of $70.42, for a total transaction of $1,139,958.96. Following the sale, the senior vice president now directly owns 55,856 shares of the company’s stock, valued at $3,933,379.52. The disclosure for this sale can be found here. Insiders have sold a total of 142,386 shares of company stock valued at $9,956,870 over the last ninety days. 0.47% of the stock is currently owned by insiders.

Shares of NetApp opened at $76.98 on Monday, MarketBeat reports. The company has a quick ratio of 1.86, a current ratio of 1.89 and a debt-to-equity ratio of 0.75. NetApp Inc. has a one year low of $37.55 and a one year high of $77.84. The firm has a market capitalization of $20.82 billion, a price-to-earnings ratio of 25.75, a PEG ratio of 1.83 and a beta of 1.25.

NetApp (NASDAQ:NTAP) last announced its quarterly earnings results on Wednesday, May 23rd. The data storage provider reported $1.05 EPS for the quarter, beating the Thomson Reuters’ consensus estimate of $1.01 by $0.04. NetApp had a net margin of 1.29% and a return on equity of 33.87%. The firm had revenue of $1.64 billion during the quarter, compared to the consensus estimate of $1.60 billion. During the same period last year, the firm earned $0.86 EPS. The business’s quarterly revenue was up 10.8% compared to the same quarter last year. equities analysts expect that NetApp Inc. will post 3.54 earnings per share for the current fiscal year.

The business also recently disclosed a quarterly dividend, which will be paid on Wednesday, July 25th. Stockholders of record on Friday, July 6th will be issued a dividend of $0.40 per share. This is an increase from NetApp’s previous quarterly dividend of $0.20. This represents a $1.60 dividend on an annualized basis and a dividend yield of 2.08%. The ex-dividend date is Thursday, July 5th. NetApp’s payout ratio is currently 26.76%.

Several equities research analysts have recently issued reports on NTAP shares. UBS Group raised their price target on shares of NetApp from $70.00 to $71.00 and gave the stock a “buy” rating in a research note on Wednesday, March 28th. Zacks Investment Research upgraded shares of NetApp from a “hold” rating to a “buy” rating and set a $76.00 price target for the company in a research note on Tuesday, April 17th. Royal Bank of Canada raised their price target on shares of NetApp to $80.00 and gave the stock a “sector perform” rating in a research note on Friday. William Blair upgraded shares of NetApp from a “market perform” rating to an “outperform” rating in a research note on Tuesday, April 17th. Finally, Argus lifted their price objective on shares of NetApp to $76.00 and gave the company a “buy” rating in a research note on Thursday, April 12th. Two equities research analysts have rated the stock with a sell rating, ten have assigned a hold rating, twenty have given a buy rating and one has given a strong buy rating to the stock. The stock has an average rating of “Buy” and an average target price of $66.46.

NetApp Profile

NetApp, Inc provides software, systems, and services to manage and store computer data worldwide. It offers flash; flash arrays that support data management; hybrid arrays to deploy the speed of flash storage; hybrid cloud; ONTAP cloud storage data management service; NetApp cloud sync hybrid data management Software as a Service; NetApp private storage for cloud; and AltaVault cloud-integrated solutions.

Profund Advisors LLC lifted its stake in shares of NetApp Inc. (NASDAQ:NTAP) by 14.1% in the 1st quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 9,660 shares of the data storage provider’s stock after purchasing an additional 1,193 shares during the period. Profund Advisors LLC’s holdings in NetApp were worth $596,000 at the end of the most recent quarter.

Profund Advisors LLC lifted its stake in shares of NetApp Inc. (NASDAQ:NTAP) by 14.1% in the 1st quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 9,660 shares of the data storage provider’s stock after purchasing an additional 1,193 shares during the period. Profund Advisors LLC’s holdings in NetApp were worth $596,000 at the end of the most recent quarter.  Domino’s Pizza (NYSE:DPZ) was downgraded by Zacks Investment Research from a “buy” rating to a “hold” rating in a research note issued to investors on Thursday.

Domino’s Pizza (NYSE:DPZ) was downgraded by Zacks Investment Research from a “buy” rating to a “hold” rating in a research note issued to investors on Thursday.