Image: Ocean Rig Poseidon from OET.

Investment ThesisOcean Rig UDW (ORIG) emerged from a devastating bankruptcy on September 21, 2017, which left common shareholders bruised and with only an infinitesimal fraction of what they have invested initially in the company.

That day, Ocean emerged with a fresh balance sheet whereas shares outstanding decreased to 8,975 shares, after implementing a 1-for-9,200 reverse stock split of the then-existing shares of the company's issued common stock. Furthermore, the company issued an aggregate of 90,651,603 common shares of the company under the scheme for a total outstanding of 90,660,578 shares.

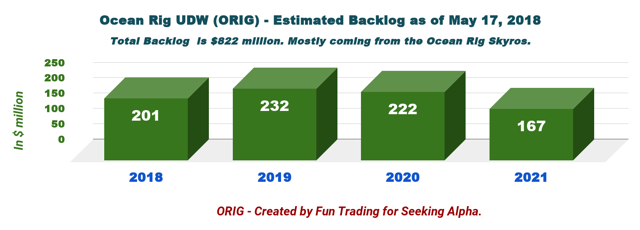

The new company is now in a better financial shape with a balance sheet more suitable to survive until the floaters' recovery that many expect will take effect late this year or early 2019. The company backlog is still significant at approximately $822 million as of May 15, 2018.

One caveat, the backlog is based on one single long-term contract with Total (NYSE: TOT) until September 2021, which is renegotiated at the moment and could be either extended or worse terminated with compensation.

Note: In case of early termination, the company said that the deal is protected by a proper termination clause that will secure over $600 million in payment, which is still a potential net loss of $140-160 million in backlog.

On April 20, 2018, the company, under the previously announced agreement, made the $35.0 million interim yard installment payment to Samsung Heavy Industries in connection with the construction of the Ocean Rig Santorini. Under the agreement with SHI, the delivery of the Ocean Rig Santorini has been postponed to September 2019 but may be brought forward at the option of the company.

Pankaj Khanna, the CEO, said in the previous conference call:

If the rig is not fixed then there are termination payments, which basically is a waterfall, starting with 100% for 180 days and then it's 90%, 75% and drops down to 50%. But in essence, it's a $600 million decision that the customer has to make.

ORIG data by YCharts

ORIG data by YCharts

ORIG offers an opportunity at under $25, assuming we effectively experience a floaters' recovery later this year. I see a recovery more likely now that oil prices trade between $75 and $80 per barrel. Mr. Khanna said in the conference call:

Oil prices have on an outward trajectory since the middle of 2017, but the improvement has accelerated in 2018 due to fundamentals and geopolitical factors. Brent prices have touched $80 per barrel as the U.S. withdrew from the JCPOA agreement with Iran. The re-imposition of sanctions on Iran could mean the removal of up to 1 million barrels per day of crude oil exports from the country. That is a strong positive for the oil prices.

This favorable opinion has been echoed by some other offshore drillers recently such as Transocean (NYSE: RIG), which is the poster child of the industry.

However, it is still too early to bet on such bullish forecast and its effects on Ocean Rig's bottom line, and I recommend to invest only a small amount at this level.

Pankaj Khanna, the CEO, said in the conference call:

[W]e would like to remind you of our high-quality assets. We own 5 6th generation assets that have a strong proven track record in Brazil and West Africa and 4 high-spec 7th generation drillships. When the market recovers, these assets will be significant cash generators. Despite the market downturn, our financial flexibility allows us to high-grade our assets further as demonstrated by the installation of the MPD kit for the Ocean Rig Mykonos and potentially also for the Ocean Rig Corcovadom, which is already MPD ready. In addition, we are exposed with the harsh environment segment, operating the Leiv Eriksson in Norway.

Stock repurchase planOn April 16, 2018, Ocean Rig UDW's Board of Directors announced it had authorized a stock repurchase plan, under which the company may repurchase up to $150 million of its outstanding common shares for 12 months from a date to be determined by the Board.

Ocean Rig may repurchase shares in privately negotiated or open-market purchases by applicable securities laws and regulations, including Rule 10b-18 of the Securities Exchange Act of 1934, as amended. Commencement of the Plan will be at the discretion of and subject to the approval of the company's Board of Directors.

No change this quarter.

Ocean Rig Balance sheet - The Raw Numbers| ORIG | 3Q'16 | 4Q'16 | 1Q'17 | 2Q'17 | 3Q'17 | 4Q'17 | 1Q'18 |

| Total Revenues in $ Million | 508.01 | 452.56 | 302.81 | 284.50 | 200.85 | 219.35 | 194.14 |

| Net Income in $ Million | 287.19 | 155.60 | 92.19 | 56.82 | ��233.83 | 79.42 | 54.85 |

| EBITDA | 463.64 | 320.52 | 179.92 | 120.98 | ��129.01 | 131.31 | 75.29 |

| Profit margin % (0 if loss) | 0.57 | 0.34 | 0.30 | 0.00 | 0.00 | 0.36 | 0.28 |

| EPS diluted in $/share | 18 991 | 17 339 | 10 300 | 6 305 | ��16 634 | 28.09 | 0.60 |

| Operating Cash flow in $ Million | 229.91 | 84.39 | - | 367.53 | 99.62 | 76.22 | 106.73 |

| CapEx in $ Million | 217.65 | 29.07 | - | 24.59 | 11.90 | 0.51 | 5.79 |

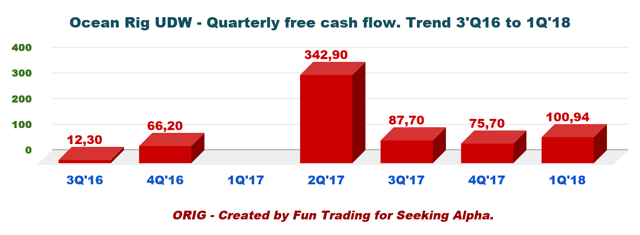

| Free Cash Flow in $ Million | 12.30 | 66.20 | - | 342.90 | 87.70 | 75.70 | 100.94 |

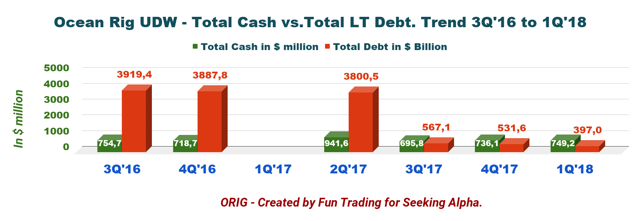

| Total Cash in $ million | 754.7 | 718.7 | - | 941.6 | 695.8 | 736.1 | 749.2 |

| Total Debt in $ Billion | 3919.4 | 3887.8 | - | 3800.5 | 567.1 | 531.6 | 397.0 |

| Shares outstanding (diluted) in million | 0.151 | 0.092 | 0.090 | 0.090 | 90.661 | 91.568 | 91.568 |

Source: company filing and Morningstar.

For the first quarter of 2018, the company reported net income of $54.9 million, or $0.60 basic and diluted earnings per share as compared to a net income of $92.2 million, or $10,300.45 basic and diluted earnings per share, for the three-month period ended March 31, 2017.

Free cash flow is now $607.24 million on a yearly basis.

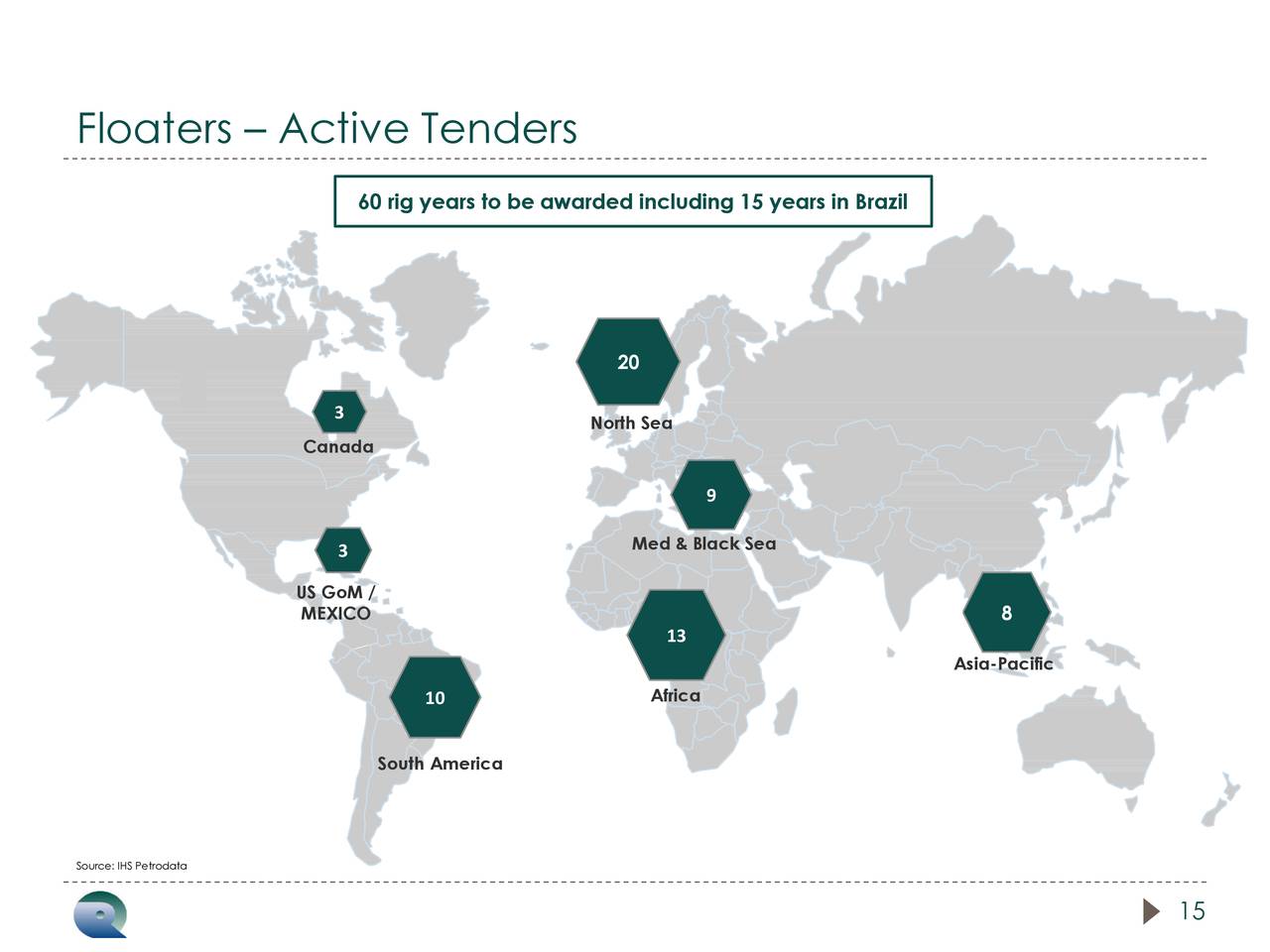

The deepwater and ultra-deepwater have not shown any definitive signs of a nascent recovery despite the fact that we are experiencing a bullish momentum in oil prices which are now trading at nearly $80 per barrel looks like the magic bullet.

Meanwhile, the recent presentation is giving a good look at what is going on, and the number of tenders around the world for floaters is impressive but are not totally what the offshore drilling industry needs the most. Pankaj Khanna, the CEO, said in the conference call:

However, the length of programs awarded is quite short as reflected by the graph on the left. This reflects the phenomenon of the last couple of years, where most of the development projects have been field expansions, Phase 2s and tie-backs and very little exploration. Therefore, most oil companies have been taking rigs for a well-by-well campaign

Source: ORIG Presentation 1Q'18

Nonetheless, it is encouraging for ORIG, especially for 2019.

Furthermore, ORIG had no net debt as of March 31, 2018, and total cash is $749.2 million at the end of 1Q'18, with total long-term debt around $397 million (This estimate would explain the use of $150 million for a shares buyback potential.)

On May 8, 2018, the company prepaid in full the remaining outstanding balance of $43.8 million on its $462 million senior secured credit facility, with no prepayment penalty.

It is a good balance sheet, and ORIG seems attractive now. However, a better approach, in my opinion, is to wait patiently one to two more quarters before triggering the buy button. The risk is perhaps too high for the reward potential, and a trading strategy may be more suitable for the stock?

Note: One significant negative is the price per share that I find too high and will not allow a considerable increase potential in the near and midterm future. It is something that an investor should keep in mind.

Technical analysis

ORIG experienced a decisive breakout yesterday and crossed its rising wedge pattern with substantial volume. A rising wedge is generally considered bearish and is usually found in downtrends, but in this case, I expect ORIG to re-test $29 (double top - sell flag) and eventually retrace.

However, ORIG will continue to trend up only if oil prices can maintain their bullish momentum and I am not convinced that oil can keep going up.

I expect ORIG to eventually to re-test its new support at $25.40 (buy flag) and eventually trend up again after that. I recommend a very cautious accumulation due to the history of this company.

Author's note: Do not forget to follow me on the oil sector. Thank you for your support, I appreciate it. If you find value in this article and would like to encourage such continued efforts, please click the "Like" button below as a vote of support. Thanks!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment